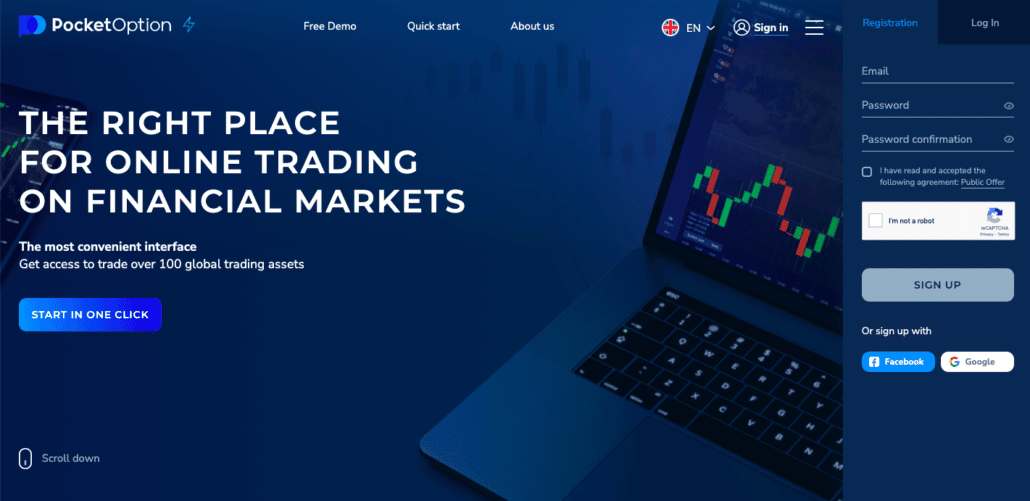

In today’s financial landscape, ensuring compliance with anti-money laundering (AML) regulations is paramount for maintaining the integrity and security of trading platforms. The Pocket Option AML Policy https://pocketoption-2024.com/fi/aml-policy/ outlines the measures and procedures that are in place to combat money laundering and to uphold a safe environment for investors and traders alike. This article delves into the key components of this policy, illustrating its significance for both the platform and its users.

Anti-money laundering refers to the laws, regulations, and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. For trading platforms like Pocket Option, adhering to AML regulations is essential not only for legal compliance but also for building trust with clients and enhancing the platform's reputation in the financial sector.

The importance of a robust AML policy is underscored by the increasing scrutiny regulatory bodies place on financial transactions. Violations can lead to significant penalties, legal repercussions, and loss of customer trust. Thus, having an effective AML strategy is not just a matter of compliance; it is a cornerstone of strategic risk management.

The Pocket Option AML Policy encompasses several critical components to ensure comprehensive protection against money laundering activities:

One of the foundational aspects of the policy is Customer Due Diligence. This involves verifying the identity of customers before establishing a business relationship. Pocket Option employs a robust verification process that includes collecting identification documents, proof of address, and other relevant information to ascertain the user's identity and assess the risk involved in the relationship.

Another essential element is ongoing transaction monitoring. Pocket Option continuously analyzes transactions to detect suspicious activities that may indicate money laundering. This includes establishing thresholds for large transactions, unusual patterns, and irregular trading behavior which may trigger an investigation or further scrutiny.

Should suspicious activities be detected, the Pocket Option AML Policy mandates prompt reporting to the appropriate authorities. These reports are crucial in helping law enforcement identify and dismantle money laundering schemes, further solidifying the platform’s commitment to combating financial crime.

Employees at Pocket Option receive extensive training on AML regulations and the company’s policies. This ensures that all staff are equipped to recognize potential money laundering activities and are familiar with the procedures for reporting them. Comprehensive training reinforces the AML culture across the organization.

To enhance the effectiveness of the AML Policy, Pocket Option integrates advanced technology solutions. These tools help in automating the process of customer verification, transaction analysis, and reporting, thus facilitating a quicker and more accurate response to potential issues.

Adhering to international standards is another focal point of the Pocket Option AML Policy. The platform aligns its practices with guidelines set forth by various regulatory bodies, including the Financial Action Task Force (FATF). Compliance ensures that Pocket Option not only meets local regulatory requirements but also upholds a global commitment to preventing money laundering.

Regulatory authorities play a vital role in shaping AML policies. Their regulations provide a framework that trading platforms must navigate. This collaboration between organizations like Pocket Option and regulatory bodies is crucial for sharing insights and solutions to enhance the effectiveness of AML measures.

The Pocket Option AML Policy benefits users in several ways. First and foremost, it safeguards their funds and personal information from potential criminal activity. Furthermore, by maintaining a secure trading environment, the platform assures users that they are engaging in legitimate transactions, ultimately enhancing their overall trading experience.

While the Pocket Option AML Policy is comprehensive, the ever-evolving nature of financial crime poses ongoing challenges. Criminals are continually developing new techniques to launder money, necessitating that trading platforms adapt their policies and procedures accordingly. Continuous improvement and vigilance are key in this battle.

Additionally, as technology evolves, so too must the tools used to combat financial crime. Artificial intelligence and machine learning are increasingly being integrated into AML strategies, providing platforms with enhanced capabilities to detect and prevent suspicious activities.

In conclusion, the Pocket Option AML Policy represents a critical commitment to preventing money laundering within the trading environment. By incorporating thorough customer due diligence, ongoing monitoring, transaction reporting, staff training, and compliance with international standards, Pocket Option demonstrates its dedication to fostering a secure trading ecosystem for its users. As the landscape of financial crime continues to change, Pocket Option remains vigilant, always seeking to enhance its AML policies to safeguard its valued clients.